Previously only certain goods and services. All supplies of local and imported goods and services which are now subject to GST at the standard rate of 6 will be subject to GST at zero rate 0 beginning 1 June 2018.

Gst In Malaysia Will It Return After Being Abolished In 2018

Please be informed that with effect from 1 January 2018 details in item 15 of GST-03 return will be amended from Total Value of GST Suspended under Item 14 to Total Value of Other Supplies.

. Effective 1 June 2018 the rate of GST will be reduced from six to zero percent. Malaysia adopts a self-assessment system which means that the responsibility to determine the correct tax liability lies with the taxpayer. Sage 300 Malaysia.

The Good and Service Tax GST will be zero-rated effective on June 1 st 2018 as announced by Finance Ministry. When recording transactions for GST reporting these are the codes that is used. Below is a summary of the points for taxpayers to consider during the transition period.

The Goods and Services Tax GST in Malaysia will be set to zero percent 0 effective 1 June 2018. May 2018 Malaysia. Create new Tax Authority for SST.

With lack of details on specific revenue and expenditure measures including the reintroduction of Sales and Services Tax SST many are left wondering how will the removal. The new Prime Minister of Malaysia has committed to withdrawing the 6 Goods and Services Tax setting it at zero from 1 June 2018. Supplies made between 1 June and 1 September 2018 are liable to zero GST and should be.

June 2018 is the FY ending 30 June 2018. GST Tax Codes in MYOB. GST is charged at standard rate of 0 on the value of the removal of goods.

September 2018 may issue a tax invoice or invoice after 1st September 2018 and account for tax in the final return. Malaysians will have a tax holiday that will see a gap between when the Goods and Services Tax GST is abolished at the start of June and when the. PM Mahathir Mohamad has promised to withdraw the consumption tax which was only introduced in April 2015.

GST Tax Codes for Purchases. What is the GST treatment. The credit note shall be issued for these goods returned with 6 GST adjustment.

GST tax codes for purchases and supplies. Why remove GST. The goods were supplied on 15 June 2018.

When GST was first introduced on 1 April 2015 at a rate of 6 it. Here is a list of tax codes that are. What is the tax treatment.

GST tax compliance updates in MYOBABSS. You should change all GST tax codes from 6 to 0 on 1st June 2018 onward. Registered person who fails to account and pays the tax commits an offence.

It was a news welcomed by both consumers and businesses alike. The then Government of Malaysia tabled the first reading of the Bill to repeal GST in Parliament on 31 July 2018 Dewan Rakyat. GST code Rate.

Once the tax rate changed any transaction which uses the amended GST Code will be 0 automatically. GST was replaced with the Sales Tax and Service Tax starting 1 September 2018. The access to the tax code list menu is the same for both MYOB Accounting and MYOB Premier.

After the 2018 election the newly elected Prime Minister Mahathir Mohamad intention to scrap a six per cent Goods and Services Tax GST within 100 days has economists and budget analysts on edge about the ripple effects. Zero-rate and continue to comply to all GST requirements under the current legislation which includes the issuance of tax invoices GST tax codes submission of GST returns for the respective taxable. All the pricing has been revised with zero-rated of GST.

From 1 June 2018 Malaysias Goods and Services Tax will be zero-rated while the Sales and Services Tax is expected to make a comeback. GST treatment if the tax invoice is issued on 01 June 2018. GST standard rate of 0.

After Pakatan Harapan won the 2018 Malaysian general election GST was reduced to 0 on 1 June 2018. GST should be charged at standard rate of 6. It will be replaced by a more limited Sales and Services Levy a sales tax.

Here are some scenarios of the taxable period that may run over. Any GST due and payable and not yet accounted in the final return shall be accounted and paid by amending the final return. Goods Services Tax 0.

All income of persons other than a company limited liability partnership co-operative or trust body are assessed on a calendar year basis. The Goods and Services Tax GST will be set at zero percent beginning June 1 2018 says the Finance Ministry. Image via Bernama via NST.

The services were. In a statement the Ministry said that the reduction of the rate from. The Goods and Services Tax GST will be zero-rated for all items and services in Malaysia from June 1 2018 the Finance Ministry announced.

The Ministry of Finance had announced on 16 May 2018 that the GST rate will be lowered to 0 effective 1 June 2018. First change the default tax rate Rate 2 of tax code such as G GST Code for SR and TX GST code from 6 to 0 then enter the old rate 6 in Rate 1 field and set the changeover date to 1 June 2018. A new tax code at the rate of 0 need to be created SR-0 or any code that the company uses for standard rated local supplies at 0 on or after 01 June 2018.

This tax code needs to be declared in column 5 a of the GST-03 return. A credit note to cancel that invoice and subsequently issue a new invoice with sales tax at 10. May 17 2018.

On the 1 June 2018 the new Malaysian government withdrew the Goods and Services Tax GST. All GST registered companies are required to issue tax invoice with showing 0 GST on after 1 June 2018. GST on importation of goods and removal of goods from Free Zone to the Principal Customs Area Malaysia except Langkawi Labuan and Tioman for example are now set at zero percent.

GST at 0 from June 1 2018. GST Tax Codes Malaysia. The tax codes list window displays all the GST codes available in MYOB.

Goods returned to suppliers where the goods purchased at the time of GST is 6 and the goods returned to supplier at the time GST is 0. To view the GST Tax Codes in MYOB open your company file then click on Lists Tax Codes as shown in the image below. Malaysia scrapping GST from June 2018.

Changes in GST 2018. In Malaysia except permitted by DG to be kept outside Malaysia iii. Goods Services Tax 0.

Main Changes in GST-03 and Tax Code with effective from 112018. It was replaced with a sales and services tax SST on 1 September 2018. Enagic Malaysia Sdn Bhd shall adhere to such instruction until further announcement has been made by the government.

Payment of the goods only made on 6 September 2018. Tax invoice has been issued before 01 June 2018. However payment was made after 01 June 2018.

Dear Valued Distributors Enagic Malaysia Sdn Bhd has revised most of its documentations May 31st 2018 as announced by the government pertaining to the Good and Service Tax GST recently. As a registered business Enagic Malaysia Sdn Bhd are still subjected to all current regulations.

Gst Will Enhance Competitiveness

Malaysia Scrapping Gst From June 2018 Solarsys

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Interest On Delayed Gst Payment Whether Payable On Gross Or Net Tax Liability

The Amount Of Monthly Gst Collections Has Reached Trillion Marks For The First Time Since The Beginning Of Gst Registration Which Ind Trillion Marks Banksters

Malaysia Sst Sales And Service Tax A Complete Guide

Pdf An Analysis Of Gst And Third Party Consideration

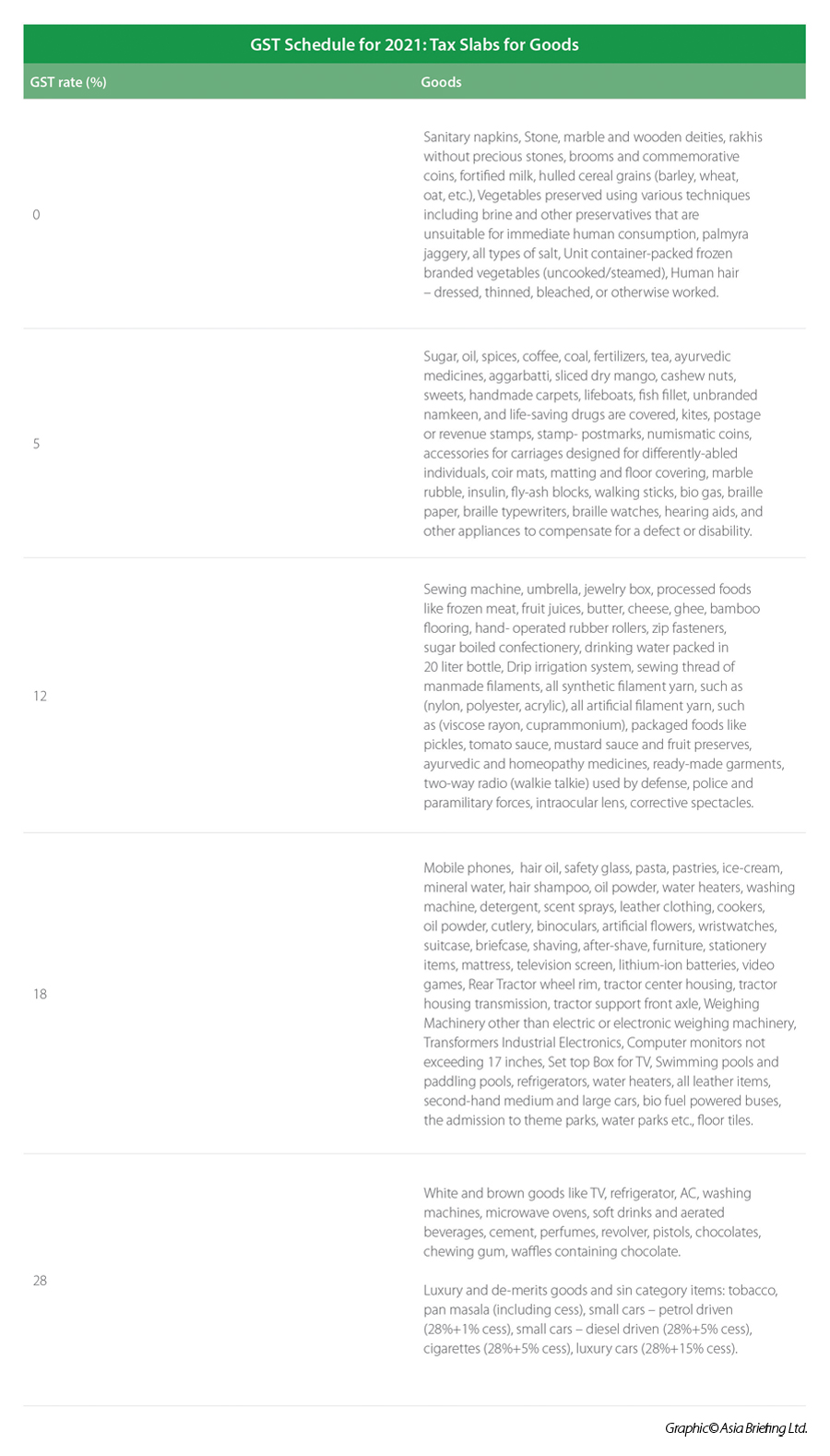

What Is Gst In India Tax Rates Key Terms And Concepts Explained India Briefing News

What India Can Learn From Failure Of Malaysia S Gst Mint

Pdf A Preliminary Assessment Of Transition Of Sst To Gst Tax Regime Of Smes

Pdf Goods And Services Tax Gst The Importance Of Comprehension Towards Achieving The Desired Awareness Among Malaysian